The Looming Collapse: America's $34 Trillion Debt Spiral and the War on Crypto

Unraveling the Complex Interplay Between Monetary Policy, Regulation, and the Future of Money

The United States finds itself ensnared in a fiscal paradox that has been decades in the making. The federal government's reliance on debt issuance has escalated to a critical point, where the mechanics of its financial management now resemble a Ponzi scheme more closely than a sustainable economic strategy. In this Skywert Briefing we argue that this is not merely a provocative metaphor but a stark reality of the current fiscal dynamics of the United States.

The government's aggressive stance against cryptocurrencies, which pose a potential threat to the dollar's dominance, can be seen as a desperate attempt to maintain control over the monetary system and protect the fragile debt-based economy. As the U.S. debt crisis deepens, the crackdown on decentralized finance appears to be a symptom of a larger systemic problem that threatens the very foundation of the world’s financial stability.

PART I: The Looming US Debt Crisis

The United States is facing an unprecedented debt crisis that threatens to destabilize the global economy and reshape the financial landscape. As the world's largest economy and the issuer of the global reserve currency, the US dollar, the United States has long enjoyed a privileged position in the international monetary system. However, this position is now under threat as the country's debt levels continue to soar, and investors grow increasingly wary of the sustainability of the US government's fiscal policies.

At the heart of the US debt crisis lies a fundamental imbalance between government spending and revenue. For decades, the US government has consistently spent more than it has collected in taxes, resulting in persistent budget deficits.

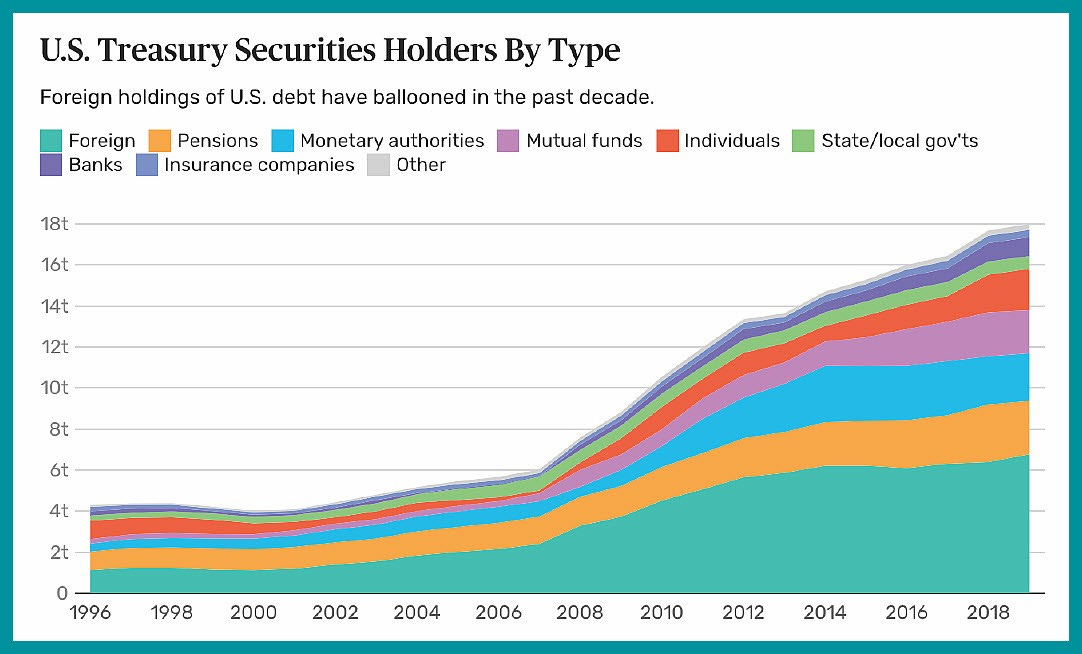

To finance these deficits, the government has relied on issuing Treasury securities, effectively borrowing money from investors both domestically and abroad. This practice has been the norm for 49 of the past 53 years.

The US government's reliance on debt issuance to finance its spending reminds of a Ponzi scheme. In a Ponzi scheme, new investor money is used to pay off old investors, creating an unsustainable cycle that eventually collapses under its own weight. Similarly, the US Treasury issues new debt to pay off maturing debt and cover interest payments, effectively relying on new investors to keep the scheme afloat.

What makes the US debt situation particularly concerning is that the largest buyer and owner of US government debt is the US government itself! Through the Federal Reserve's quantitative easing programs and other monetary policy interventions, the US governments has effectively been printing money to buy its own debt.

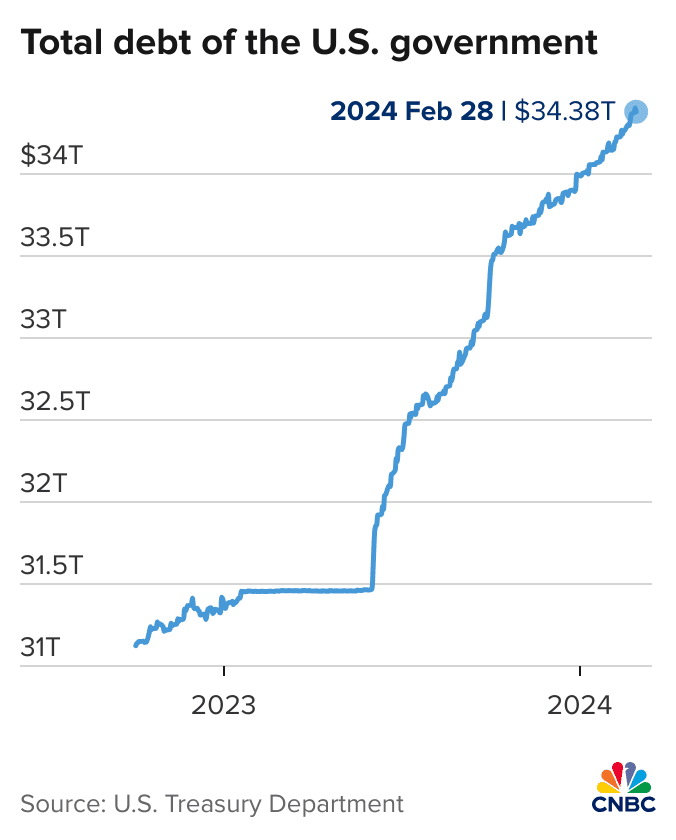

As of May 2024, the total US national debt stands at a staggering $34.7 trillion, a figure that has grown exponentially in recent years. To put this number into perspective, it would take over 30,000 years to count to one trillion seconds, and the current US debt is 34.7 times that amount.

The Treasury's Buyback Strategy

This recursive loop of debt issuance and purchase lays bare a fundamental vulnerability a the heart of the world's largest economy–a vulnerability that is exacerbated by the recent maneuvers to manage this burgeoning debt.

In a significant move, the US treasury has announced its first buyback program since 2002, set to commence on May 29, 2024. This initiative aims to inject liquidity into the treasury market by conducting weekly buybacks amounting to $2 billion per operation. While ostensibly designed to enhance market functioning and resilience, this strategy raises serious questions about the underlying health of the treasury market and, by extension, the US economy.

The Inflation Spiral

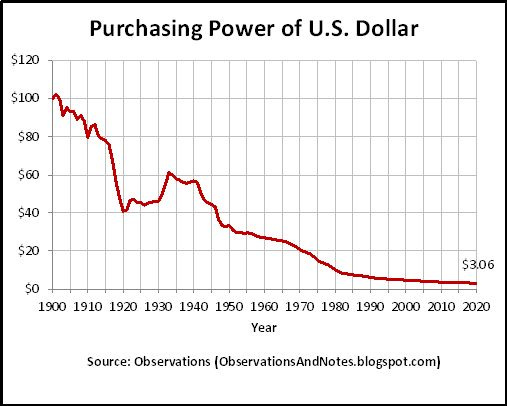

The US government's reliance on debt issuance and money printing to finance its spending has significant inflationary consequences. As more money is pumped into the economy, the purchasing power of each dollar decreases, leading to rising prices for goods and services. This inflationary pressure is compounded by the fact that the US dollar serves as the global reserve currency, meaning that any loss of confidence in the dollar's value could have far-reaching consequences for the global economy.

In recent months, inflation in the US has accelerated to levels not seen in decades. Despite the Federal Reserve's efforts to tame inflation through interest rate hikes, prices continue to rise, and there are growing concerns that the US economy could be entering a period of stagflation, characterized by high inflation and low economic growth.

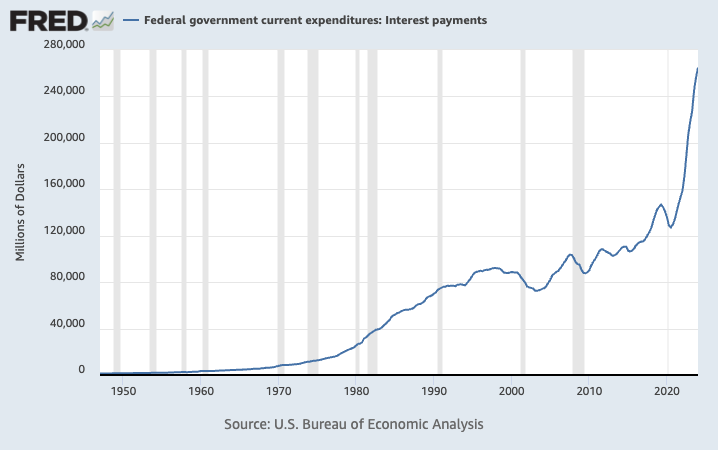

The Federal Reserve's role in this scenario is equally critical. With interest rates pegged at 5.25% to curb inflation, the Fed finds itself in a precarious position. High interest rates, while intended to moderate borrowing and spending, have the unintended consequences of increasing the government's debt service burden. This, in turn, necessitates further debt issuance, perpetuating a cycle that threatens to undermine the very objectives of monetary tightening.

Moreover, the recent uptick in inflation, which has consistently outpaced the Fed's 2% taget, adds another layer of complexity. The Fed's high-interest rate regime, aimed at taming inflation, is proving insufficient against the backdrop of aggressive fiscal deficits and expansive monetary policies historically pursued.

The Debt Spiral

The combination of rising debt levels, inflationary pressures, and waning investor confidence has created a perfect storm for the US economy. As interest rates rise to combat inflation, the cost of servicing the US government's debt also increases, putting further strain on the country's fiscal position. This, in turn, leads to even larger budget deficits and more debt issuance, creating a vicious cycle that is becoming increasingly difficult to break.

The US government now finds itself in a precarious position, caught between the need to maintain investor confidence in the Treasury market and the risk of exacerbating inflationary pressures through continued money printing. Any misstep could trigger a crisis of confidence in the US dollar, leading to a sharp sell-off in Treasury securities and a potentially catastrophic rise in borrowing costs for the US government.

The Inevitability of a Crisis

At Skywert, we believe that the US debt crisis is a ticking time bomb that threatens to upend the global financial system. The US reliance on debt issuance and money printing to finance its spending has created an unsustainable Ponzi scheme that is now unraveling before our eyes. As inflation spirals out of control and investor confidence wanes, the US government finds itself in an increasingly untenable position.

The consequences of a US debt crisis would be far-reaching and devastating. A loss of confidence in the US dollar could trigger a global financial meltdown, as investors rush to dump US assets and seek safe havens elsewhere. The resulting economic upheaval could plunge the world into a deep recession, with untold human suffering and geopolitical instability.

PART II: The Case for Cryptocurrencies

As the US debt crisis unfolds, it is becoming increasingly clear that the current monetary system, based on fiat currencies and central bank control, is fundamentally flawed and unsustainable. The time has come for a new paradigm, one that is based on sound money, decentralization, and individual sovereignty. The rise of cryptocurrencies and other alternative assets represents a glimmer of hope in an otherwise bleak financial landscape, offering the promise of a more stable, equitable, and resilient monetary system for the future.

Gold: The Traditional Safe Haven

Historically, gold has been the go-to asset for investors seeking to protect their wealth during times of economic turmoil. As a tangible, scarce, and universally recognized store of value, gold has proven its resilience throughout history, often appreciating in value when fiat currencies falter.

However, gold also has its limitations. It can be difficult and expensive to store and transport, and its value can be subject to manipulation by central banks and other large players in the market. Moreover, gold's usability as a medium of exchange is limited, as it cannot be easily divided or transferred in small amounts.

Cryptocurrencies: The Digital Alternative

Cryptocurrencies, particularly Bitcoin, have emerged as a digital alternative to gold and fiat currencies. Like gold, cryptocurrencies like Bitcoin and Bitcoin Cash are scarce and cannot be easily manipulated by central authorities. With a capped supply of 21 million coins, they stand in stark contrast to the limitless printing of fiat currencies. However, they offer several key advantages over gold in terms of usability and accessibility.

One of the primary advantages of cryptocurrencies is their usability as a medium of exchange. Unlike gold, which must be physically divided and transferred, cryptocurrencies can easily be divided into smaller units and transferred instantly across borders at low cost. This makes them well-suited for everyday transactions, as well as for larger purchases and investments.

Moreover, cryptocurrencies can be easily integrated into existing financial infrastructure, such as payment processors and online marketplaces. This allows for seamless adoption and use by businesses and individuals alike, further enhancing their usability and potential for widespread adoption.

Another key advantage of cryptocurrencies is their accessibility. Unlike gold, which must be physically stored and secured, cryptocurrencies can be easily stored and accessed through digital wallets on smartphones or computers. This makes them accessible to anyone with an internet connection, regardless of their location or financial status.

Moreover, cryptocurrencies operate on decentralized networks, meaning that they cannot be enforced by the same restrictions and regulations as traditional financial institutions. This allows for greater financial inclusion and empowerment, particularly for individuals in developing countries or those who may be excluded from the traditional banking system.

This decentralized nature is perhaps the most significant advantage of cryptocurrencies over gold and fiat currencies. Cryptocurrencies operate on distributed ledgers, such as the blockchain, which are maintained by a network of users rather than a central authority. This makes them resistant to censorship, manipulation, and control by governments or financial institutions.

Moreover, cryptocurrencies are secured by advanced cryptography and consensus mechanisms, making them virtually impossible to counterfeit or double-spend. This provides a level of security and trust that is unmatched by traditional financial systems, which are often vulnerable to hacking, fraud, and other forms of malfeasance.

The Potential Alternative to the US Dollar

Given their usability, accessibility, and decentralized nature, cryptocurrencies have the potential to emerge as the leading alternative to the US dollar and other fiat currencies. As the US debt crisis continues to unfold and confidence in the dollar wanes, cryptocurrencies offer a vision of a more open, secure, and equitable financial system.

While Bitcoin (BTC) has established itself as the leading cryptocurrency, it faces significant challenges in becoming a viable alternative to traditional fiat currencies for everyday transactions. For cryptocurrencies to truly serve as a global medium of exchange, they must offer near-zero fees and fast transaction times to accommodate the needs of the majority of the world's population. As of today, Bitcoin has become slow and burdened with unsustainably high fees, making it impractical for small, daily transactions such as buying a coffee or groceries. This limitation has led to the perception of Bitcoin as a digital alternative to gold—a store of value rather than a practical currency.

Consequently, other cryptocurrencies like Bitcoin Cash, Monero, Dash, or Digibyte, which prioritize low fees and fast transactions, may emerge as leading contenders for widespread adoption as a true digital currency. Unless Bitcoin addresses these key issues, it risks losing its potential to become a universal medium of exchange, paving the way for other cryptocurrencies to fill this crucial role in the global financial landscape.

A growing adoption of cryptocurrencies by businesses and institutions will further enhance their legitimacy and mainstream appeal. As more companies begin to accept cryptocurrencies as payment and more investors allocate a portion of their portfolios to digital assets, the network effects and liquidity of cryptocurrencies are likely to increase, making them an even more attractive option for those seeking alternatives to the US dollar.

PART III: The Escalation of Anti-Crypto Measures

Less surprisingly, as the US debt crisis deepens, in what appears to be a coordinated effort to undermine the credibility and stability of this alternative financial system, the US government has launched a series of aggressive actions against influential figures, companies, and technologies in the crypto space.

At Skywert, we believe that this crackdown on cryptocurrencies is not merely a coincidence but rather a calculated move by the US government to maintain its grip on monetary control and suppress the rise of cryptocurrencies and decentralized finance.

In recent years, the US government has ramped up its efforts to regulate and control the cryptocurrency industry. From President Biden's executive order on the "responsible development of digital assets" to the arrests of prominent figures like Sam Bankman-Fried (SBF) and CZ (Binance), the government has made it clear that it will not tolerate any challenge to its monetary authority.

The crackdown on cryptocurrencies has been particularly intense in the spring of 2024, with a flurry of aggressive moves targeting influential businessmen, companies, and technology. The arrests of Tornado Cash developers Roman Storm and Roman Semenov, the shutdown of Samourai Wallet and arrest of the founders, and the SEC's actions against Consensys and its Metamask Wallet are just some examples of the government's relentless pursuit of crypto-related entities.

The U.S. government's crackdown on prominent cryptocurrency figures and businesses has intensified in recent weeks, with a series of high-profile arrests and investigations targeting influential individuals in the crypto space. On April 26, 2024, the U.S. Department of Justice reopened its long-standing case against Kim Dotcom, a vocal cryptocurrency advocate, seeking to extradite him to face charges related to his now-defunct file-sharing platform, MegaUpload. Just days later, on April 30, 2024, early Bitcoin investor and entrepreneur Roger Ver was arrested in Spain on tax evasion charges, with the U.S. government pushing for his extradition. The following day, federal prosecutors launched an investigation into former Twitter CEO Jack Dorsey and his companies, Cash App and Square, for allegedly processing cryptocurrency transactions for terrorist groups and sanctioned nations.

These actions, coupled with the U.S. easing some sanctions on Russian banks while Russia announced plans to ban non-Russian cryptocurrencies, paint a picture of a government increasingly hostile towards decentralized finance and those who champion it. The FBI's alert warning people against using unregistered cryptocurrency money transmitting services and Senator Elizabeth Warren's letter associating cryptocurrencies with child sexual-abuse materials further underscore the government's aggressive stance.

By employing a multi-pronged approach, including regulatory pressure, law enforcement actions, and political rhetoric, the US government is sending a clear message: it will not tolerate any challenge to its monetary control and will use all means necessary to suppress the rise of decentralized finance. This coordinated effort to demonize and undermine cryptocurrencies reveals a deep-seated fear of losing grip on the reins of financial power and a willingness to resort to scare tactics and misinformation to maintain the status quo.

The Motivations Behind the Crackdown

At Skywert, we believe that the US government's crackdown on cryptocurrencies is driven by a combination of factors, including the fear of losing control over the monetary system, the need to maintain the status quo, and the desire to protect the interests of the traditional financial industry.

The US government's monetary control is based on the US dollar's status as the world's reserve currency and the Federal Reserve's ability to manipulate interest rates and money supply. The rise of cryptocurrencies poses a significant threat to this control, as it offers an alternative financial system that is decentralized, transparent, and resistant to manipulation.

Another significant factor motivating the crackdown is the government's desire to maintain financial surveillance. Cryptocurrencies can provide anonymity and privacy in transactions, making it more challenging for government agencies to track financial flows and enforce tax regulations and anti-money laundering (AML) standards. This aspect of cryptocurrencies is often highlighted in regulatory discussions, with governments citing the need to combat illegal activities such as money laundering, terrorism financing, and tax evasion.

Moreover, the traditional financial industry, which has long benefited from its close ties to the government and its ability to control the flow of money, sees cryptocurrencies as a direct threat to its business model. The adoption of cryptocurrencies could lead to a significant reduction in the demand for traditional banking services, as individuals and businesses increasingly turn to decentralized finance solutions.

The Implications for the Future of Finance

The US government's crackdown on cryptocurrencies has far-reaching implications for the future of finance, both in the United States and globally. By targeting influential figures and companies in the crypto space, the government aims to instill fear and uncertainty in the minds of potential investors and users, potentially stifling innovation and deterring individuals from participating in the decentralized finance movement.

The U.S. stance on cryptocurrencies could set a precedent for other nations, leading to a domino effect of restrictive regulations worldwide. This global tightening could hinder the widespread adoption and development of cryptocurrencies, delaying or even derailing the potential benefits these technologies could offer in terms of financial inclusion and efficiency.

However, as the US debt crisis deepens and the stability of the US dollar comes under increasing pressure, the demand for alternative financial systems is likely to grow. As more individuals and institutions begin to recognize the potential of cryptocurrencies as a store of value and medium of exchange, their adoption and legitimacy are likely to continue to increase, despite the government's efforts to suppress them.

Conversely, the crackdown could also galvanize the cryptocurrency community, leading to accelerated innovation in decentralized finance (DeFi) solutions designed to circumvent traditional financial systems and regulatory frameworks.

The aggressive regulatory approach towards cryptocurrencies in the U.S. risks stifling innovation in one of the most dynamic sectors of the global economy. By imposing stringent regulations, the US government may inadvertently push the development of blockchain and cryptocurrency technologies to more favorable jurisdictions, inevitably causing the U.S. to fall behind in this tech race.

The Skywert Perspective

At Skywert, we believe that the future of finance lies in decentralized systems that are transparent, secure, and resistant to manipulation. While the US government's crackdown on cryptocurrencies may slow down the adoption of these systems in the short term, it is unlikely to stop the inevitable march towards a more decentralized and equitable financial future.

Moreover, we believe that decentralized cryptocurrencies have already reached a momentum which makes them antifragile to governmental interventions. Instead of preventing the adaption, the US government's crackdown on cryptocurrencies will achieve the opposite and make them more robust and resilient as users and businesses will embrace non-custodial solutions and create secure decentralized exchanges.

The US government's crackdown on cryptocurrencies is a complex and multifaceted issue that has far-reaching implications for the future of finance. While the government's actions may be driven by a desire to maintain control over the monetary system and protect the interests of the traditional financial industry, they risk stifling innovation and driving the development of decentralized finance solutions underground.