The Future of Supplements: Personalized Nutrition Technology

Ushering in the End of One-Size-Fits-All Solutions

Introduction

In the sweltering heat of the 1893 World's Columbian Exposition in Chicago, Clark Stanley captivated audiences with his "rattlesnake oil"—a supposed cure-all he claimed to have learned from Hopi medicine men. With dramatic flair, Stanley sliced open a live snake, plunged it into boiling water, and skimmed off the oil that rose to the surface. The crowds were enthralled, and Stanley's elixir flew off the shelves.

Of course, we now know that Stanley's snake oil was merely a concoction of mineral oil, beef fat, and red pepper. The term "snake oil salesman" became synonymous with fraud and quackery. Yet, his story is emblematic of the supplement industry's early days—a wild west of unsubstantiated claims, questionable ingredients, and outright fraud.

Fast forward a century, and the supplement industry has grown into a behemoth, with a valuation expected to reach $308 billion by 2028. This growth was catalyzed by the discovery of vitamins in the early 20th century. In 1912, Polish biochemist Casimir Funk coined the term "vitamine" to describe essential micronutrients that prevent diseases like scurvy and beriberi. This breakthrough led to the isolation and synthesis of individual vitamins, and by the 1940s, the first commercial vitamin supplements hit the market.

These early supplements marked a significant step forward from the snake oil era, but they were still far from the targeted, science-backed products we see today. Despite explosive growth, many of the same problems persist: one-size-fits-all formulations, opaque manufacturing practices, and a lack of rigorous scientific backing remain common.

Change is on the horizon. As consumers become increasingly health-conscious and tech-savvy, they demand more from their supplements. They want products personalized to their unique needs, backed by rigorous science, and delivered with radical transparency. They want supplements that truly work.

This demand, coupled with advances in genomics, microbiome science, and AI, is setting the stage for a supplement revolution. In the coming years, we'll see hyper-personalized formulations tailored to an individual's DNA, gut bacteria, and real-time health data. Bioengineered nutrients that outperform their natural counterparts will emerge, alongside a shift towards radical transparency with blockchain-verified supply chains and publicly available testing results.

Perhaps most excitingly, we'll see a new era of consumer empowerment, where individuals can co-create their own supplements, experimenting with evidence-backed ingredients to optimize their health in ways once unimaginable.

For entrepreneurs and investors, this revolution presents tremendous opportunities. Companies that harness these trends and technologies will not only disrupt a $250 billion industry but also transform the health, vitality, and longevity of millions worldwide.

In this briefing, we will explore the key trends shaping the future of the dietary supplement industry and identify unconventional investment opportunities that are poised for growth in the coming years. We will examine how exponential technologies are enabling the development of personalized nutrition solutions, the rise of "smart" supplements, and the emergence of new distribution channels that are transforming the way consumers access and purchase supplements.

By the end of this briefing, readers will have a clear understanding of the disruptive forces shaping the future of the dietary supplement industry and the investment opportunities emerging as a result. We'll challenge conventional wisdom and present a contrarian outlook on where the industry is headed, highlighting the companies and technologies poised to win in the years ahead.

Market Overview

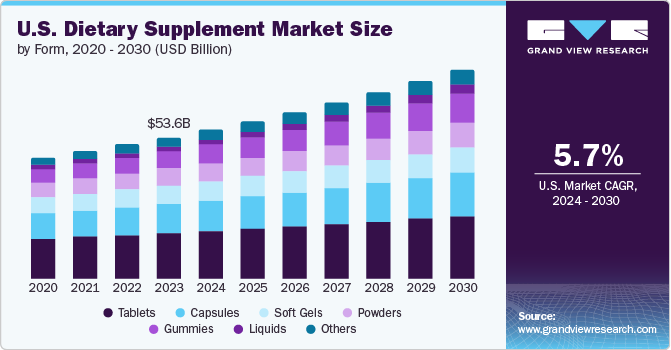

The global dietary supplement market has experienced substantial growth, reaching a market size of $177.5 billion in 2023. Projections indicate continued expansion at a robust CAGR of 9.1% from 2024 to 2030, with an estimated value of $327 billion by 2030. The U.S. market, a significant contributor, was estimated at $54 billion in 2023, with a projected CAGR of 5.7% from 2024 to 2030.

Several key drivers propel this growth, including:

Increasing health consciousness: Consumers proactively seek dietary supplements to enhance overall well-being.

Aging population: Older adults require additional nutritional support to maintain health and address age-related concerns.

Prevalence of chronic diseases: The rise in obesity, diabetes, heart diseases, and cancer drives demand for dietary supplements.

Busy lifestyles and changing dietary patterns: Hectic lifestyles and shifts in dietary habits lead consumers to fill nutritional gaps with supplements.

Sports nutrition and fitness trends: Increased participation in sports and fitness activities fuels demand for supplements supporting performance, recovery, and overall health.

Preventive healthcare focus: Consumers view supplements as a proactive measure to prevent health issues.

E-Commerce: The rise of e-commerce and direct-to-consumer channels improves product accessibility.

As the market expands, companies are investing in research and development to create innovative products targeting specific health concerns and consumer preferences. Novel ingredients, personalized nutrition approaches, and a focus on plant-based and clean-label products are expected to shape the market in the coming years.

Market Segmentation

In 2023, the dietary supplement market was dominated by several key segments:

Vitamins (A, B, C, and D) and Multivitamins accounted for a substantial 30% market share.

Energy and weight management supplements, primarily influenced by sports enthusiasts, held over 30% share.

Adults, particularly working individuals seeking to maintain a healthy lifestyle, were the largest consumers with a 46.01% revenue share.

OTC sales dominated with a 75.5% revenue share, expected to witness steady growth due to rising consumer awareness of nutritional value and health benefits.

Offline sales accounted for over 80% of revenue, bolstered by an increase in medical practitioner-prescribed supplements for treating various health issues.

Tablets, known for their high-quality excipients aiding in absorption and disintegration, held a 32.3% revenue share.

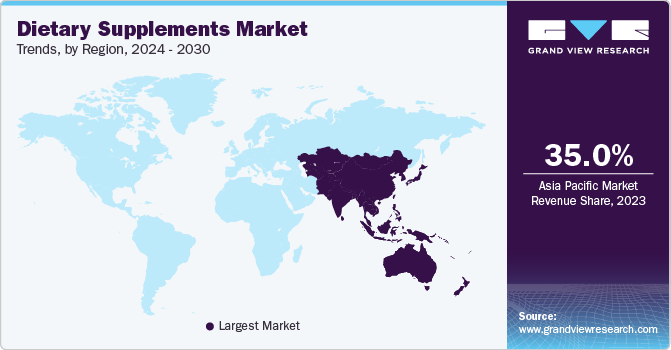

The Asia Pacific region was dominant, with a 34.9% revenue share, and is anticipated to witness increasing demand as key participants introduce their brands in the untapped markets of Southeast Asia.

Key Industry Trends

The dietary supplement industry is undergoing a profound transformation, driven by shifting consumer preferences, technological advancements, and a growing focus on personalized health. Several key trends are shaping the future of the industry:

Shift Towards Personalized Nutrition

The industry is moving away from a one-size-fits-all approach toward personalized nutrition. Consumers increasingly demand supplements tailored to their unique health profiles, genetic makeup, and lifestyle factors. This trend recognizes that individual nutrient requirements vary widely, and customized supplementation can optimize health outcomes.

Personalized nutrition offers supplement companies a chance to differentiate themselves in a crowded market. By leveraging technologies like AI, machine learning, and genetic testing, companies can develop targeted formulations that address specific health concerns. However, this shift requires significant investments in R&D, data analytics, and supply chain flexibility.

In the personalized nutrition space, Viome stands out alongside Nutrigenomix and 23andMe. Viome uses AI and microbiome analysis to offer personalized health solutions, Nutrigenomix focuses on genetic testing for tailored nutrition, and 23andMe provides consumer genetics services to inform personalized dietary choices.

Plant-Based and Sustainable Supplements

Demand for plant-based and sustainable supplements is rising as consumers seek eco-friendly and ethically sourced alternatives. Concerns about environmental impact, animal welfare, and personal health are driving this trend.

To capitalize on this trend, companies are developing innovative plant-based formulations, sourcing sustainable ingredients, and adopting eco-friendly packaging. Demonstrating a genuine commitment to sustainability and transparency will resonate with environmentally conscious consumers and capture a larger market share.

In the realm of plant-based and sustainable supplements, Plant People, Moon Juice, and New Chapter are leading the charge. Plant People emphasizes regenerative agriculture and minimal plastic use, Moon Juice offers adaptogens with recyclable packaging, and New Chapter focuses on non-GMO ingredients and zero-waste production practices.

Integration of Supplements with Functional Foods and Beverages

The line between supplements and functional foods is blurring as consumers seek convenient ways to incorporate health-promoting nutrients into their diets. This trend creates opportunities for supplement companies to expand their product portfolios and tap into the growing functional food and beverage market.

By integrating supplements into functional foods and beverages, companies can appeal to consumers who prefer to obtain their nutrients from whole food sources rather than pills or powders. This trend is driving innovation in product formulation, with companies developing novel delivery formats such as gummies, chews, and effervescent tablets that offer a more engaging and enjoyable supplement experience. Companies are also exploring synergistic combinations of nutrients and bioactive compounds that can enhance the health benefits of functional foods and beverages.

Innovation in product formulation is key, with companies developing novel delivery formats like gummies and effervescent tablets. Collaborating with food and beverage manufacturers, ensuring ingredient stability and bioavailability, and navigating regulatory landscapes are crucial for success.

In the integration of supplements with functional foods and beverages, established companies like PepsiCo, Nestlé, and USANA Health Sciences are leading the way. PepsiCo innovates with nutrient-rich beverages, Nestlé enhances food products with bioactive compounds, and USANA focuses on science-based functional foods that promote overall wellness.

Growing Interest in Longevity and Anti-Aging Solutions

As the global population ages, interest in supplements promoting healthy aging and longevity is growing. Consumers seek products that maintain physical and cognitive function, prevent chronic diseases, and extend health spans.

To meet this demand, supplement companies are developing targeted formulations that address the key mechanisms of aging, such as oxidative stress, inflammation, and cellular senescence. They are also exploring novel ingredients such as nicotinamide mononucleotide (NMN), resveratrol, and rapamycin analogs, which have shown promise in preclinical studies of aging and longevity.

However, the anti-aging market is rife with hype and misinformation. Success requires rigorous scientific research, transparency, and collaboration with healthcare professionals to ensure product safety and efficacy. As the market matures, expect increased consolidation, partnerships, and investment in this promising area.

In the longevity and anti-aging supplement sector, Elysium Health, Tru Niagen, and Life Extension are prominent players. Elysium Health offers DNA-based personalized supplements, Tru Niagen focuses on NAD+ boosters, and Life Extension provides a range of scientifically-backed anti-aging products.

Technological Impact

The consumer trends are encountering a supplement industry that is undergoing a technological metamorphosis, driven by the convergence of exponential technologies. By harnessing artificial intelligence, biotechnology, nanotechnology, 3D printing, and the Internet of Things (IoT), the industry is poised to deliver solutions that are not only personalized and targeted but also highly effective in optimizing individual health outcomes. This transformation will disrupt traditional business models and empower consumers with unprecedented control over their well-being.

Artificial Intelligence and Machine Learning

AI and machine learning are central to the personalization of supplement formulations. By analyzing vast amounts of health data, including genetic information, microbiome composition, and lifestyle factors, AI can recommend tailored supplement regimens. This personalization ensures consumers receive the right nutrients in the right doses, enhancing supplement effectiveness.

Moreover, AI enables predictive health modeling, allowing companies to address potential health concerns proactively. By identifying patterns and risk factors, AI can predict an individual’s likelihood of developing certain conditions and recommend preventive supplement protocols. This shift from reactive to proactive health optimization marks a significant industry change.

AI also revolutionizes product development. By analyzing consumer preferences, market trends, and scientific research, companies can create innovative formulations that meet evolving demands. This data-driven approach accelerates innovation and ensures new supplements are backed by robust scientific evidence.

Biotechnology and Synthetic Biology

Biotechnology and synthetic biology are opening new frontiers in nutrient production and delivery. Advances in biotechnology and genetic engineering allow for lab-grown nutrients that are identical to natural counterparts but more sustainable and cost-effective.

Engineering probiotics and microbiome modulation represent groundbreaking applications. By designing probiotics that produce specific nutrients or modulate the gut microbiome, companies can develop personalized solutions addressing individual health needs.

Gene-tailored supplements epitomize personalized nutrition. By analyzing genetic profiles, companies can identify specific nutrient requirements and develop formulations that optimize gene expression and cellular function, unlocking new levels of health optimization and disease prevention.

Nanotechnology

Nanotechnology revolutionizes nutrient delivery and bioavailability. By encapsulating nutrients in nano-sized particles, companies enhance absorption and targeted delivery to specific tissues. This technology overcomes traditional formulation limitations, improving bioavailability and systemic absorption.

Nano-encapsulation also stabilizes sensitive nutrients, preserving efficacy over time. This is crucial for antioxidants, probiotics, and other delicate compounds prone to degradation.

Smart packaging and anti-counterfeiting measures are critical applications. Incorporating nano-sensors into packaging allows for monitoring product integrity, detecting tampering, and preventing counterfeiting, ensuring consumers receive authentic, high-quality supplements.

3D Printing and Advanced Manufacturing

3D printing enables on-demand production of customized supplements. By creating personalized formulations in small batches, companies eliminate the need for large-scale production, reducing waste and environmental impact.

This technology also allows for novel delivery formats, such as multi-layered supplements that release nutrients at different rates. This precision delivery optimizes nutrient absorption and utilization.

3D printing supports sustainable, localized manufacturing. By producing supplements closer to consumption points, companies reduce transportation costs and carbon footprint, creating a resilient and adaptable supply chain.

IoT and Wearable Technology

IoT and wearable technology transform health monitoring and optimization. By integrating sensors into smart packaging and devices, companies collect real-time data on supplement usage and efficacy. This data provides insights into individual needs, allowing for dynamic adjustments to dosage and formulation.

Wearable devices track health metrics like nutrient levels and stress, providing a holistic health view. AI algorithms use this data to generate personalized supplement recommendations, advancing beyond static, one-size-fits-all approaches.

Integrating IoT and wearable tech with digital health platforms creates a seamless health optimization ecosystem. By connecting supplement data with other health metrics, individuals gain comprehensive health insights, enabling informed supplement regimen decisions. This integration is crucial for adopting personalized, data-driven supplementation.

Skywert Analysis

Based on the technological progress and consumer trends, we believe that the dietary supplement industry, long reliant on standardized solutions and traditional delivery methods, is on the cusp of a transformative revolution. Our Skywert Analysis suggests that foundational assumptions are being challenged, presenting unprecedented opportunities for entrepreneurs and investors ready to capitalize on these shifts.

The End of One-Size-Fits-All

The era of one-size-fits-all supplementation is rapidly becoming obsolete. The future lies in hyper-personalization, driven by advances in genetic testing, microbiome analysis, and real-time health monitoring. This paradigm shift will render current product lines and business models largely irrelevant.

Imagine a supplement regimen tailored not just to an individual’s genetic makeup, but dynamically adjusted based on microbiome composition, stress levels, and even environmental factors like sunlight exposure and local food availability. The opportunity lies not in traditional supplement companies, but in AI-driven platforms that can process this complex web of data and formulate real-time supplement recommendations. Within a decade, leading supplement providers will resemble tech companies more than traditional nutrition firms.

Redefining Efficacy and Bioavailability

The current approach to efficacy and bioavailability is fundamentally flawed. The future lies in integrated health ecosystems where supplements are dynamic components of holistic health platforms. Imagine a regimen that automatically adjusts based on your latest blood work, microbiome samples, sleep patterns, and emotional state as detected by wearable devices. This is the logical evolution of trends in digital health and personalized medicine.

Investors should look beyond traditional manufacturers to companies developing advanced biomarkers, AI-driven health platforms, and next-generation wearable devices. The real value will be in the ecosystem, not individual products.

The Synthetic Revolution

The industry's reverence for natural sources is a constraint that innovative companies will soon overcome. The future in dietary supplements belongs to synthetic and bioengineered nutrients that outperform natural counterparts in bioavailability, safety, and sustainability.

"Super nutrients"—synthetic compounds combining the benefits of multiple vitamins or minerals into a single molecule—will emerge, representing a new category of nutritional science. Companies at the forefront of this synthetic revolution will disrupt the supplement industry and potentially impact agriculture and global nutrition.

Investors should focus on companies at the intersection of synthetic biology and nutritional science. The potential here extends beyond supplements to address global challenges in food security and nutrition.

Reimagining Delivery

The assumption that oral ingestion is the optimal delivery method for supplements is ripe for disruption. The future points to nutrients being delivered directly to cells, bypassing the digestive system entirely.

Imagine transdermal patches delivering a day's worth of vitamins, inhalable nutrients absorbed instantly through the lungs, or nanotech-enabled supplements targeting specific cells or organs. These innovations represent a fundamental reimagining of how we interact with nutritional supplements.

Furthermore, the line between food and supplements will blur. Functional foods engineered to contain therapeutic levels of nutrients could render traditional supplements obsolete for many consumers.

Investors should consider companies developing advanced drug delivery systems, as these technologies will likely find applications in the supplement industry. Additionally, food tech companies working on nutrient-enhanced products could become major players in this new landscape.

Investment and Business Opportunities

The dietary supplement market is poised for disruption through technology. While the current landscape is dominated by conventional approaches, such as influencer-driven brands, the real opportunities lie in harnessing underappreciated technological trends. Successful companies will leverage AI, synthetic biology, nanotechnology, and 3D printing to lead the personalized nutrition revolution. Those who act now have the chance to capture significant market share.

AI-Powered Supplement Formulation and Precision Nutrition Platforms

One of the most promising opportunities is the development of AI-powered platforms for personalized supplement formulation. By using machine learning to analyze individual health data—such as genetic information, microbiome composition, and lifestyle factors—these platforms can generate highly targeted supplement recommendations.

This shift requires moving from mass manufacturing to personalized production, integrating big data and AI with precision manufacturing and medical testing. This creates a high barrier to entry, leading to market consolidation. Entrepreneurs and investors can create value by building vertically integrated platforms that combine AI-driven formulation with direct-to-consumer distribution and subscription models. Partnerships with testing companies, wearable device manufacturers, and healthcare providers will be crucial.

Blockchain technology can enhance data privacy, security, and transparency, ensuring a tamper-proof record of health data and supplement history. It can also be used in the supply chain to track ingredient sourcing and quality, boosting consumer trust.

Synthetic Biology and Fermentation-Derived Nutrient Production

Synthetic biology and fermentation technology offer disruptive potential in nutrient production. By engineering microorganisms to produce high-value compounds such as rare cannabinoids, adaptogens, and nootropics, entrepreneurs can create new categories of supplements with superior efficacy and sustainability.

Startups specializing in proprietary strains of yeast or algae can leverage advanced fermentation technologies to optimize yield and cost-efficiency. Partnerships with supplement brands and food companies can provide access to novel ingredients, while licensing technology to pharmaceutical firms can open new avenues for drug development.

Investors can pursue buy-and-build strategies, acquiring synthetic biology startups and integrating them into a nutrient production platform. Strategic investments in fermentation infrastructure can create a robust supply chain for next-generation supplements.

3D Printed Personalized Supplements with Nanotechnology-Enhanced Delivery

Combining 3D printing and nanotechnology presents a unique opportunity to create personalized supplements with enhanced bioavailability. By producing customized formulations on-demand, entrepreneurs can offer bespoke nutrition experiences tailored to individual health needs.

3D printed supplements can incorporate nanotechnology-based delivery systems to improve nutrient absorption and bioavailability. This enables the development of supplements with superior efficacy and faster onset, addressing challenges like poor solubility and degradation.

These supplements can release nutrients in a controlled manner, mimicking natural digestion and minimizing side effects. They can also be formulated with synergistic nutrient combinations targeting specific health outcomes.

Entrepreneurs can create direct-to-consumer platforms for personalized supplement recommendations and orders. Integration with smart packaging and IoT-enabled dispensers can provide real-time tracking of intake and efficacy.

Investors can support 3D printing startups specializing in personalized supplement production, providing capital for scaling operations. Strategic partnerships with established brands can offer access to cutting-edge 3D printing and nanotechnology capabilities, enabling differentiated product lines.