Jeremy Grantham, a British investor and co-founder of GMO, a Boston-based asset management firm, with over $65 billion in assets under management, is a voice one should listen to when it comes to asset price bubbles.

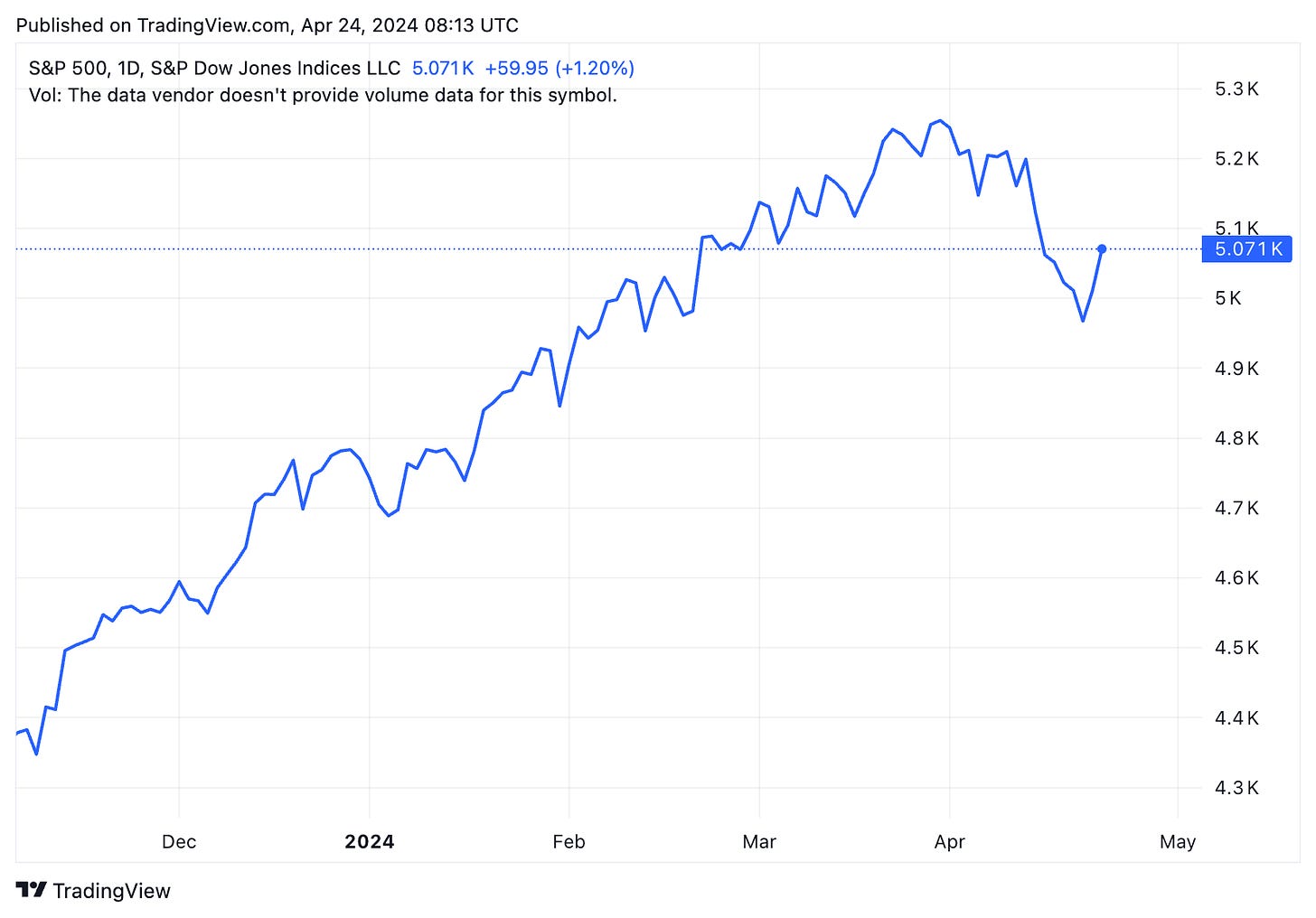

Over the past months, he raised his voice louder, expressing that the U.S. stock market is in an epic “super bubble” that could lead to a 27% correction of the S&P 500 from current (5,000+) levels, with the worst-case scenario of a 40% or 50% decline.

Why should we listen?

Jeremy Grantham not only funded one of the world’s first index funds in the 1970s, also did he built a reputation for accurately identifying asset price bubbles before they burst.

He called the Japanese asset price bubble in the late 1980s, the dot-com bubble in the late 1990s, and the U.S. financial crisis in 2008.

He also made rather premature warnings, for example did he warn in 2010 of an inflating stock market bubble that could burst in 2011, yet the S&P 500 only saw a mild correction of around 15%. Grantham has also been warning of a gigantic stock bubble since 2020 and 2021 – but more on that later.

Because of his bearish calls, which often sound alarmist and premature, he became known as a “permabear”. Nevertheless, his ability to identify speculative market manias driven by investor euphoria rather than fundamentals is a key reason why his predictions, through controversial and alarmist at the time, have typically materialized. This foresight has protected GMO investors from major losses during market crashes.

The AI Paradox of the Stock Market

Grantham describes the U.S. market as a paradox in which stock prices and corporate profits are at record levels, in a time in which the world is particularly imperfect and dangerous.

“If margins and multiples are both at record levels at the same time […] in the future is another July 1982 or March 2009 with simultaneous record low multiples and badly depressed margins.”

– Jeremy Grantham (March 2024)

In 2021, Grantham saw a stock bubble with all classical characteristics: extreme investor euphoria and a rush to IPO and going public through SPACs, and highly speculative stocks starting to decline in early 2021. Only because blue chips continued to rise did the market end with a large gain that year. This situation, describes Grantham, was unique to late-stage major bubbles of 1929, 1972, 2000, and now 2021.

The stock bubble of 2021 busted conventionally in 2022, when the S&P 500 declined more than any first half since 1939. Yet today, the S&P 500 is at an all-time high.

Why is that so?

Grantham argues that in December 2022, with the launch of ChatGPT, this historical pattern was interrupted as public awareness suddenly shifted to this new transformative technology and created a new market hype.

Even Grantham agrees that AI is – with the greatest certainty – a general-purpose technology like the internet (read our briefing “The Myth of Linear Progress”), he assumes from his vast experience that we’re now experiencing an “early massive hype and a stock market bubble” because investors focus on the ultimate possibilities of the technology and “price most of the very long-term potential […] into current market prices.” Situations which have occurred similarly with the introduction of canals, railroads, electricity, the telephone and – in the late 1990s – with the internet.

Jeremy Grantham argues that artificial intelligence will ultimately be as or even more transformative than early investors anticipate – “but only after a substantial period of disappointment during which the initial bubble bursts.”

While artificial intelligence as a technology is unprecedented and unpredictable, a historical perspective might indicate that current stock market high will deflate and – as Grantham continues his argument – will lead to a normal ending of the original 2021 bubble, which was paused in late 2022 with the launch of ChatGPT.

“It […] seems likely that the after-effects of interest rate rises and the ridiculous speculation of 2020-2021 and now (November 2023 through today) will eventually end in a recession.”

– Jeremy Grantham (March 2024)

Since Graham focuses in his analysis mostly on the U.S. stock market, he sees much more room for growth than in non-US tech stocks, with “much less risk when the bubble bursts.” Consequently, the stock market bubble is for the most part concentrated in the United States which he calls the most expensive stock market of any developed country.

History Suggests…

We believe it is impossible to reliably predict the burst of Graham’s predicted stock market bubble, above all the performance of any specific stock. Yet, we do believe that despite the chaos, one can reliably predict the overall progress of technology – which is historically following an exponential path.

Because we base our long-term forecasts on the historical analysis of exponential growth curves of technology, it only makes sense to analyze the historical patterns of stock market bubbles. History suggests that – like the dot-com bubble – we are likely witnessing excessive speculation and overvaluation in the early market leaders of artificial intelligence. This AI bubble might eventually deflate, at least temporarily, before the true long-term winners emerge.

One prime example of potential overvaluation might be Nvidia NVDA 0.00%↑ , the semiconductor giant whose stock has more than doubled in 2023, pushing its market capitalization above $1 trillion. While Nvidia’s GPUs are crucial for training large language models, the company’s valuation appears to be outpacing even the most optimistic projections for AI adoption in the near future. Additionally, Nvidia’s largest customers like Meta META 0.00%↑ and OpenAI have publicly announced that they are working on their own in-house silicon.

Also, private startups like Anthropic, the AI research company behind Claude, was recently valued at $5 billion, despite having minimal revenue. Similarly, OpenAI’s valuation reached $80 billion, despite the company having a clear monetization strategy.

The value investors among us will agree, that this reminds of the dot-com bubble, where companies little or no revenue were valued at astronomical levels based on their disruptive potential alone.

Hedging the Bubble

The real impact of AI is unpredictable at this point in time. Should companies like OpenAI – for example – live up to markets expectations and launch a drastically improved GPT5 model throughout this year, the blue chip and technology stocks might rise further, dragging the market along.

Yet, from a historical view, AI may go through a similar cycle of irrational exuberance followed by a shakeout, before emerging as a principal driver of economic value and disruption.

Besides diversification in non-US markets and non-correlated asset classes, we believe the best strategy is to hedge against the market. Taking history into account, any investor exposed to technology stocks should buy put options on potentially overvalued AI and tech leaders or the broader U.S. stock market in general. This allows investors to participate in additional growth, while protecting their portfolio from Grantham’s anticipated crash.

In this AI bubble period, a diversified blend of contrarian value plays, prudent hedges, and selective exposure to the exponential AI leaders may be the optimal approach for long-term investors.

At Skywert we believe that combining the disciplines of value investing with an exponential mindset could be the winning strategy for the years to come.